is property tax included in mortgage ontario

If they are incurred for the purpose of earning income by renting property to tenants the interest portion of the mortgage is deductible on line 8710 of the T776 Rental Income form. They figure into your GDS and TDS ratios at the time of your mortgage approval but they tend to increase over time while your mortgage generally speaking does the opposite.

7348 N Old State Road 37 First Time Home Buyers Real Estate Real Estate Listings

Home buyers amount Eligible home buyers can claim 5000 on line 369 of Schedule 1 of their income tax and benefit return for the acquisition of a qualifying home in 2017.

. Ontario administering the property tax is certainly one of the most importantnot least because the property tax is the single biggest source of revenue for municipalities. Hey all been a while since Ive posted but keep reading and learning. Property tax is a tax on land and property.

05 of the value of the property up to and including 55000. The property is a primary residence. It is based on the assessed value of a property.

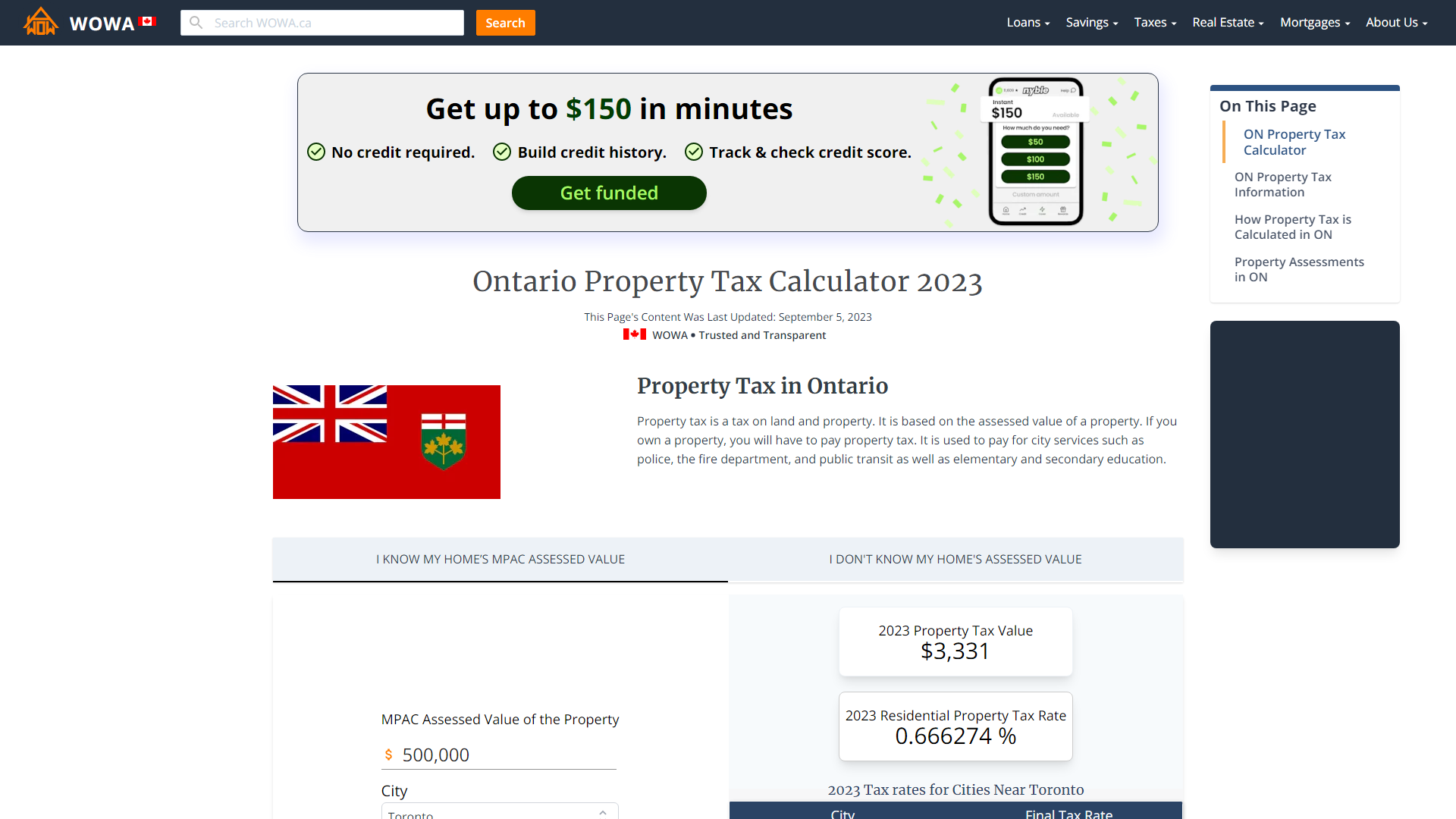

The dollar amount of property tax a homeowner will pay is calculated by multiplying your municipalitys residential rate by the assessed value of your home as determined by MPAC. Property Tax Amount Property Tax Rate x MPAC Home Assessment Why is knowing the property tax rate for different cities important. So you would owe 4875.

Having income from a long-term salaried position is the easiest way to qualify for a mortgage. Provincial land transfer tax is paid on closing and calculated on a sliding scale as follows. The maximum amount that can be received by way of credit would be 24000.

Seniors who qualify can claim up to 10000 worth of eligible home improvements on their tax return. 1 of the value which exceeds 55000 up to and including 250000. Ontario Land Transfer Tax.

Property taxes are one of those ongoing costs of owning a home that you dont really hear too much about when you get your mortgage. The Estate Administration Tax is based on the value of the estate which is the value of all assets owned by the deceased at the time of death. For more information or to apply by phone call us at 1-866-525-8622 Opens your phone app.

The Canadian governments guidelines suggest that tax deductions can only be made on mortgage interest payments when the property is used to generate rental income. The mortgage the homebuyer pays one year can increase the following year if property taxes increase. To put it simply.

Whichever option you decide upon will be a personal choice that suits your own needs and lifestyle though typically most homeowners will pay their property taxes through their mortgage as the pros tend to outweigh the cons. Assets to include real estate in Ontario less encumbrances such as a mortgage collateral mortgage or lien on the real estate. The inclusion of property taxes in mortgage payments can make for a higher closing cost when going through escrow.

Here are some of the most common types of income that you can use to qualify you for your mortgage some of which may give you more buying power than you think. Best 5-Year Variable Mortgage Rates in Canada nesto 190. If the builder has included the GSTHST in the purchase price then itll automatically be included in your mortgage.

You can find out more by undertaking a property assessment. When your mortgage interest is considered part of your operating cost for a rental property you can claim back all or a portion of the interest. It turns out that the home buyer who is eligible for this credit would be paying a provincial tax of 2 on the first 400000 of the purchase price then 8 on the balance.

Only the interest portion of the mortgage is deductible and the interest is only deductible in the original term of the loan. Only one property can be designated as a principal residence per tax year per family unit. For instance the debt you carry on credit cards loans and other credit products if managed properly and responsibly paying your bills on time and in full can actually be good for your overall credit health.

In cities like Toronto the property taxes also include an additional municipal tax. The simple answer is yes depending on how much you actually owe. Remember some debt can be good.

Some cities may add additional taxes. 325000 market value of home x 150 property tax rate Property taxes. The amount of money they get back for these expenses is calculated as 10 of the eligible expenses claimed.

Your income can be proved easily through an employment letter and recent pay. Property tax included in mortgage payment issue. If you own a property you will have to pay property tax.

For example if your lender estimates youll pay 2500 in property taxes in a year and you make your mortgage payments monthly your lender will collect an extra 20833 2500 12 20833 each month. When a homebuyer includes the property tax with monthly payments it could mean a changing mortgage amount. Dont forget though if you have any questions or would like to make any changes within your current mortgage Im always happy to take the.

In comparison a similarly-priced home in Windsor which has the highest tax rate of 1818668 would have a tax bill of 909334. However its important to note that a. So our mortgage with BMO includes the property tax component approx 95biweekly payment and this has recently changed to 185bi-weekly payment because its not enough to cover the property tax on the property.

15 of the value which exceeds 250000 up to and including 400000. The Provincial rebate portion is not capped at the 450000 like the Federal portion is. A Mortgage Advisor will get in touch with you within 3 business days discuss next steps and book a meeting at a banking centre or at your home or office.

It is used to pay for city services such as police the fire department and public transit as well as elementary and secondary education. The residential property tax in Toronto stands close to 066 percent according to the Bob Aaron firm. For example if the market value of your home is 325000 and your municipalitys property tax rate is 15 your property taxes would be.

For example a Toronto homeowner with a property valued at 500000 would pay 305507 in property taxes based on the citys rate of 0611013 the lowest on the list. The taxes are based on the assessed value of a home. For example 10000 spent.

It will collect that amount on top of your monthly mortgage payment.

Condo Vs House Current Mortgage Rates Condo Mortgage Rates

Pin On Mortgage Rate Calculator

Should You Pay Property Taxes Through Your Mortgage Loans Canada

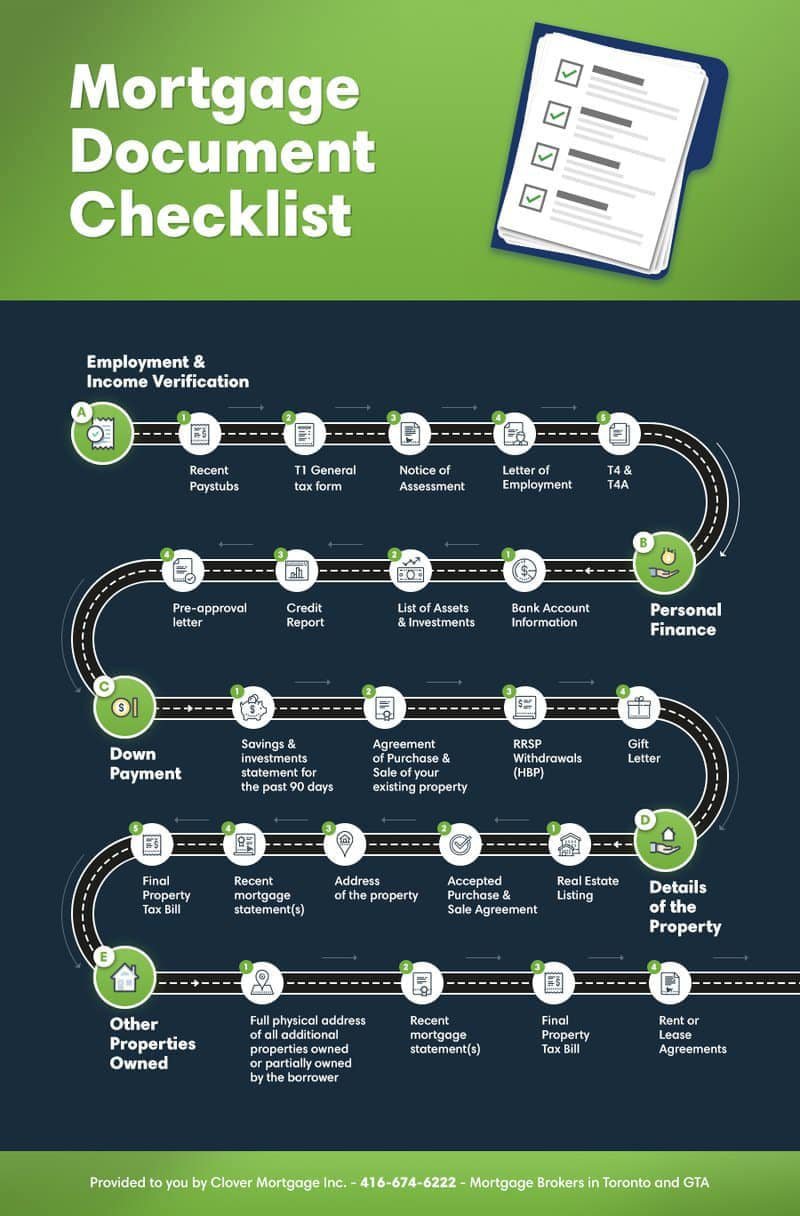

Mortgage Document Checklist What You Need Before Applying For A Mortgage

Do I Have To Pay Property Taxes Through My Mortgage Ratesdotca

Buying A Rental Income Property Canadian Mortgage Professionals

Kitchener Property Tax 2021 Calculator Rates Wowa Ca

Ontario Property Tax Rates Calculator Wowa Ca

Condo Vs House Current Mortgage Rates Condo Mortgage Rates

Looking For The Best Property Management Company In Gurgaon In 2020 Property Management Real Estate Development Property

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Lowest Refinance Mortgage Rates In Toronto Refinance Mortgage Mortgage Mortgage Rates

Should You Pay Property Taxes Through Your Mortgage Loans Canada

Should You Pay Property Taxes Through Your Mortgage Loans Canada

Loan Against Property Avail Hdfc S Loan Against Property For Your Personal Or Business Needs Both Resident Commercial Property Loan Interest Rates Loan Amount

Should You Pay Property Taxes Through Your Mortgage Ratehub Ca