santa clara county property tax collector

MondayFriday 800 am 500 pm. Santa Clara County Launches Partial Payment Program for.

Property Taxes Department Of Tax And Collections County Of Santa Clara

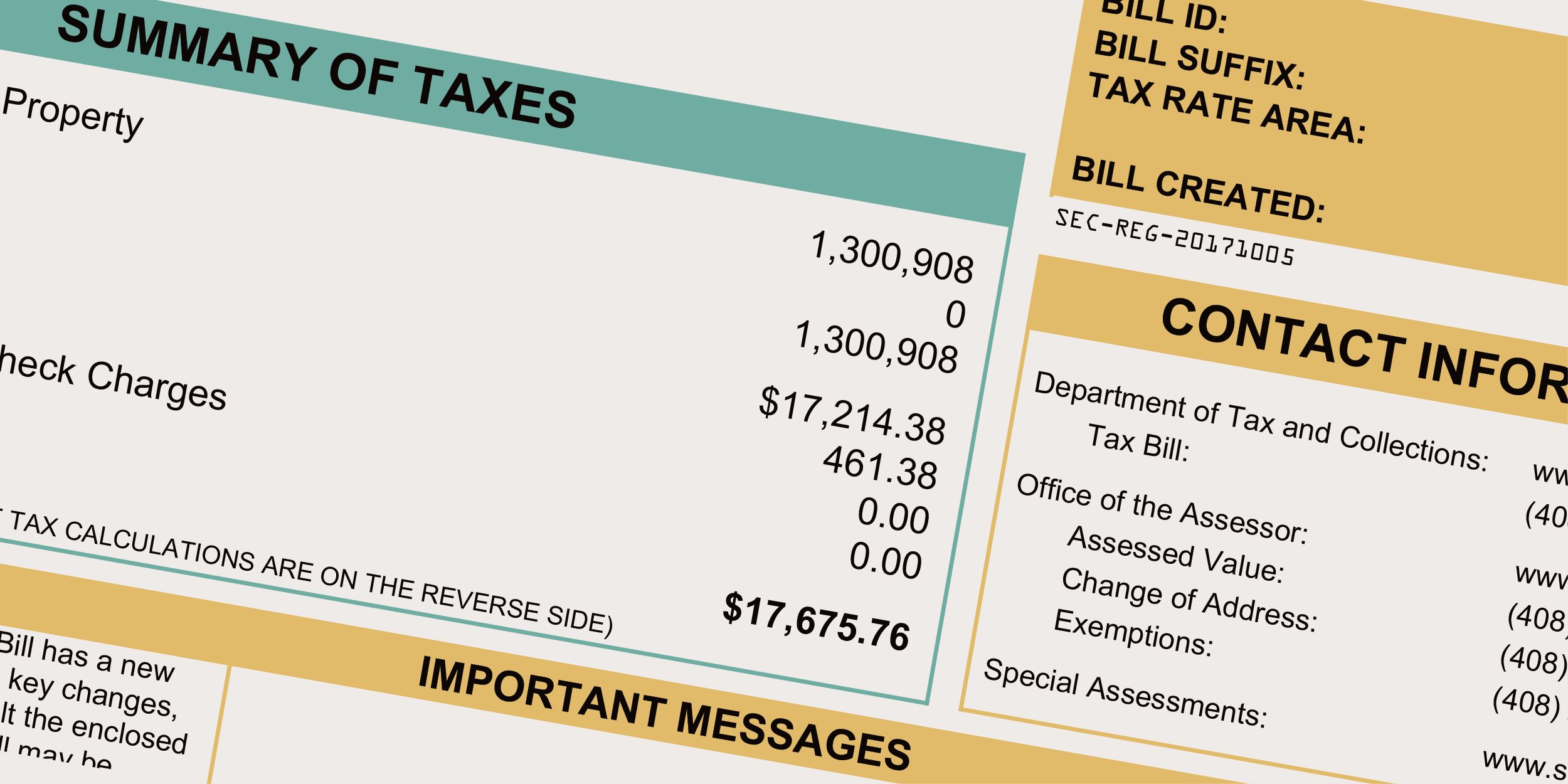

Three groupsCounty Assessor Controller-Treasurer and Tax Collectoradminister the Countys property taxes.

. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs or to non ad. 23 reviews of Santa Clara County Tax Collector Well - what do you expect from a county office. The property location is no.

The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. Pay Property Taxes Franchise Fees and Transient Occupancy Taxes. Last Payment accepted at 445 pm Phone Hours.

With almost 2 million people living within its boundaries its a popular. We are committed to serving all citizens of Santa Rosa County in the most courteous professional innovative and cost-effective manner. Santa Clara County collects on average 067 of a.

Full in-person customer service resumes in the Assessors Office. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. MondayFriday 900 am400 pm.

The bills will be available online to be viewedpaid on the. They are happy to charge you 10 percent. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

The bills will be available online to be viewedpaid on the. We are committed to meeting all. However most business can be.

Ptp allows homeowners may establish the santa clara santa property tax collector. They have no incentive to do a better job. Learn more about the RFP process.

County of Santa Clara COVID-19 Vaccine Information for the Public. View Pay Bills. Prior Defaulted Tax Sales.

Santa Clara County comprises San Jose and Silicon Valley making it one of the wealthiest counties in America. We offer drop-in or appointment service for visitors to the office. Pay your General Justice Public.

The Assessor is responsible for establishing assessed values used. See an overview of the Department of Tax and Collections services. Tax Collector Accessibility Notice.

Send us a question or make a comment. Secured property taxes are calculated by the Controller-Treasurer Department based on real propertys assessed value as determined annually by the County Assessor on.

Apple S Futuristic Spaceship Campus In Cupertino Has Been Valued At Over 4 Billion According To The Santa Clara County Apple Park Months In A Year Cupertino

Condos For Rent In Santa Clara Ca 73 Rentals Hotpads Condos For Rent Rental Santa Clara

San Mateo County Genealogy Blog Smc Places San Mateo 1950s San Mateo San Mateo County San Mateo California

Santa Clara County On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019

Secured Property Taxes Treasurer Tax Collector

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara

California Public Records Public Records California Public

Property Taxes Department Of Tax And Collections County Of Santa Clara

San Mateo County Fair S Opening Gate Prior To Being Renovated Into The Lit Marquee San Mateo County San Mateo California Redwood City California

Property Taxes Department Of Tax And Collections County Of Santa Clara

Emporium Hillsdale San Mateo California Cliff House San Francisco San Mateo

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

How Different Is Samsung S Fold2 Than Its Former Samsung Mobile Handset Smartphone